Age (not death!) and Taxes

Nov 27th, 2020

Age does matter, when it comes to tax obligations

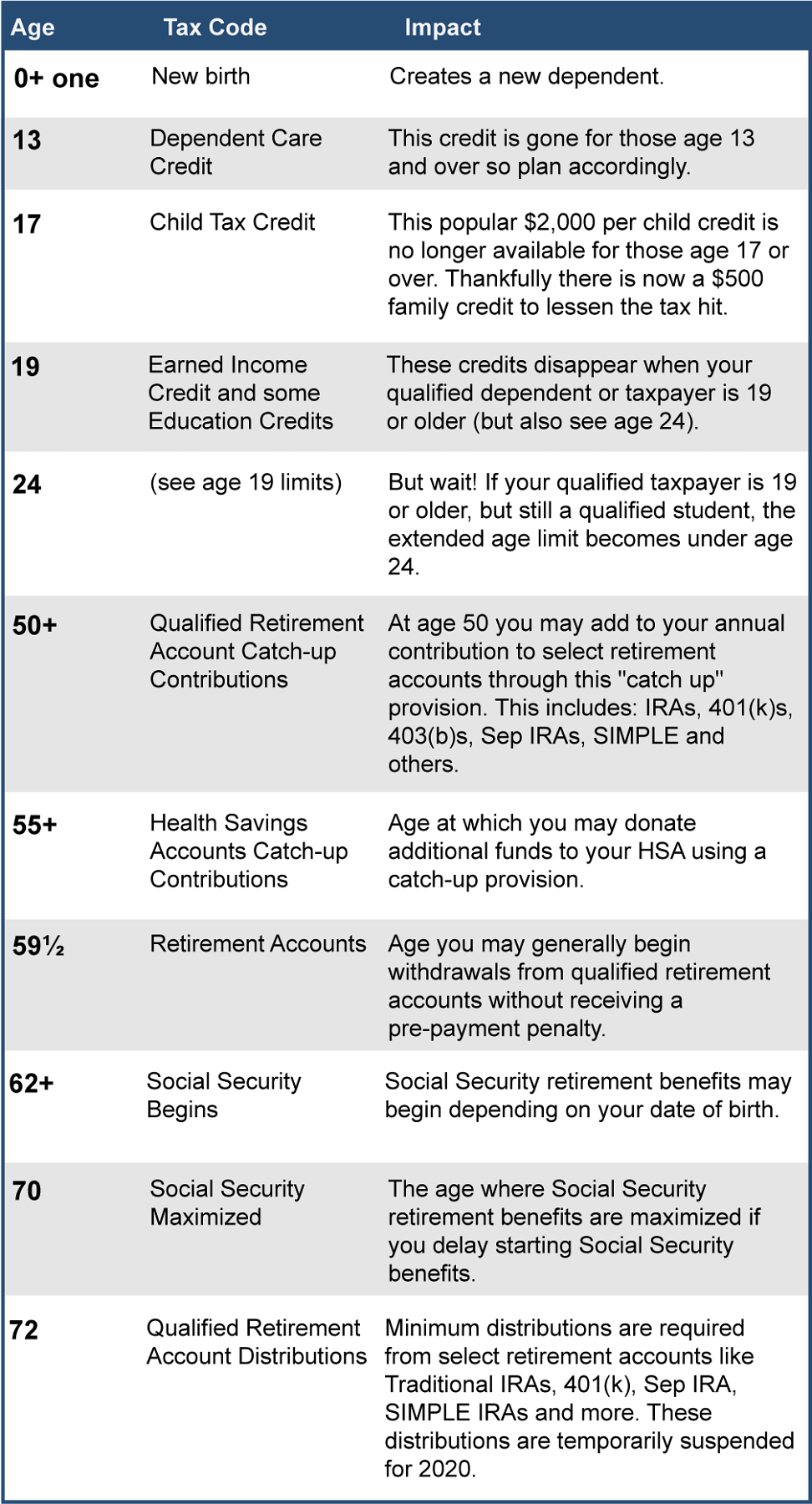

One of the elements that make our Federal Tax Code so hard to follow is that different laws apply to you based on you or your dependents' age. To help you navigate through some of this maze here is a chart that outlines key ages and how it applies to your tax obligation.

Please note: These age triggers outline some of the major tax events that relate to your age. In most cases the impacted year is the year you turn the age on this chart. Example: If your qualified dependent turns 17 any time during the year, they no longer qualify for the Child Tax Credit. This chart is not meant to be all-inclusive and there are exceptions to some of these age qualifications. Use this information to know when to ask for help.

Action step. When you or anyone in your family approaches any of the ages in this chart it is a sure sign you need to spend some time understanding the tax implications of the age event. Call if this impacts you!

Let’s Help Eliminate Your Stress

If you choose Appletree Business Services for your bookkeeping, payroll or tax needs, you’ll find that good things begin to happen in your business. Your common financial challenges will become simple with a clear map to create your ideal situation. More than that, we’ll identify your “typical” stresses and help make them go away.