Turning Your Hobby Into a Business

Jun 18th, 2021

You've loved dogs all your life so you decide to start a dog training business. Turning your hobby into a business can provide tax benefits if you do it right. But it can create a big tax headache if you do it wrong.

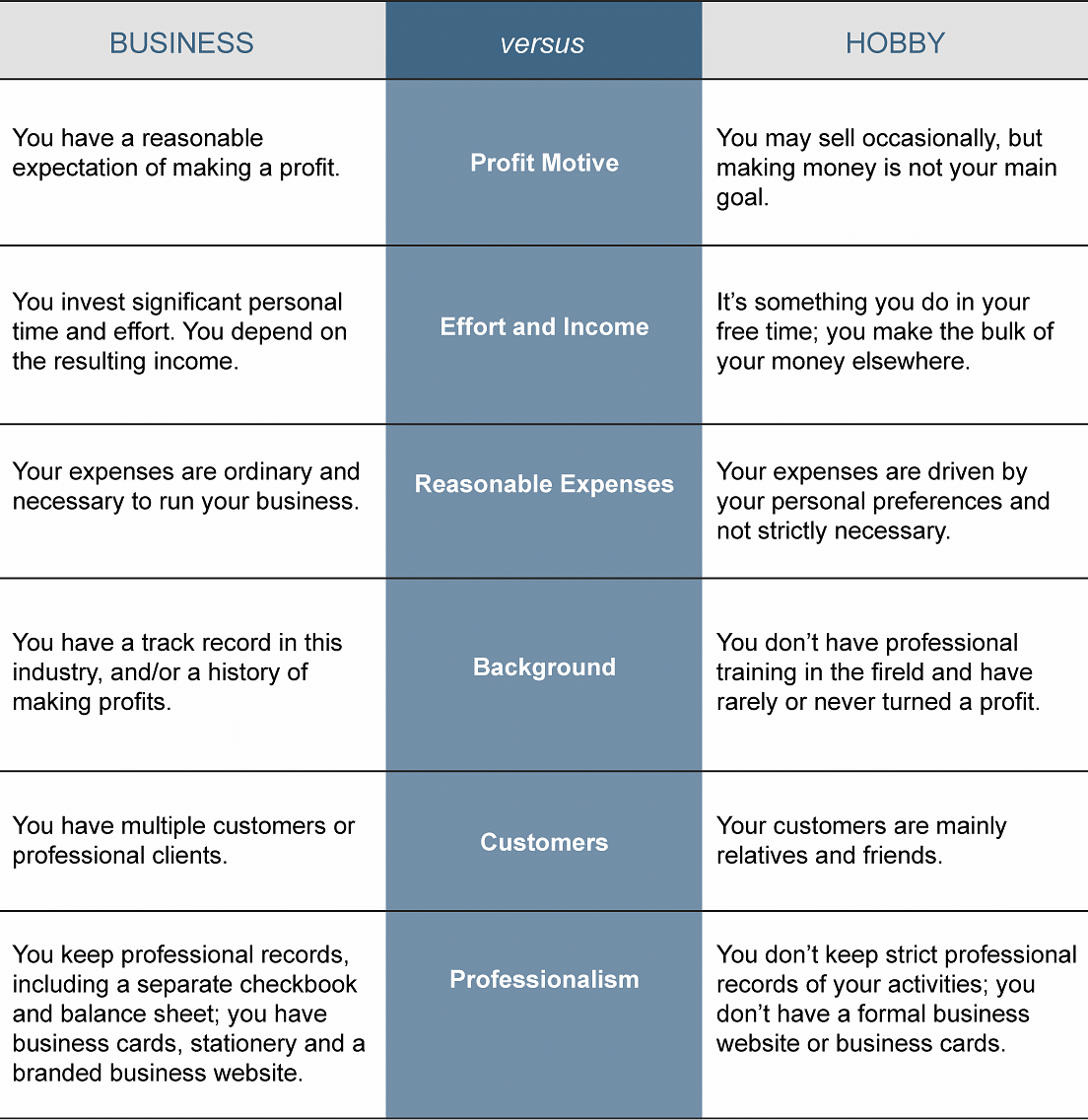

One of the main benefits of turning your hobby into a business is that you can deduct all your qualified business expenses, even if it results in a loss. However, if you don't properly transition your hobby into a business in the eyes of the IRS, you could be in line for an audit. The agency uses several criteria to distinguish whether an activity is a hobby or a business. Check the chart below to see how your activity measures up.

The business-versus-hobby test

If your dog training business (or any other activity) falls under any of the hobby categories on the right side of the chart, consider what you can do to meet the business-like criteria on the left side. The more your activity resembles the left side, the less likely you are to be challenged by the IRS.

On the other hand, if you determine that you're really engaged in a hobby, there are still some tax benefits to be had. You can treat hobby expenses as a miscellaneous itemized deduction on a tax return, but generally not more than hobby income. They can be used to reduce taxable income if they and other miscellaneous expenses surpass 2 percent of your adjusted gross income.

If you need help to ensure you meet the IRS's criteria for businesslike activity, reach out to schedule an appointment.

Let’s Help Eliminate Your Stress

If you choose Appletree Business Services for your bookkeeping, payroll or tax needs, you’ll find that good things begin to happen in your business. Your common financial challenges will become simple with a clear map to create your ideal situation. More than that, we’ll identify your “typical” stresses and help make them go away.